Sukanya Samriddhi Yojana Rate Hike: Recently the government has announced the new interest rates of Sukanya Samriddhi Yojana. Earlier this scheme was getting a return of 8% per annum but now this return has increased by 20 basis points to 8.20%. The government has started this scheme specially for girls. We will understand about this scheme in detail in today’s post. But before that what is this Sukanya Samriddhi Yojana?

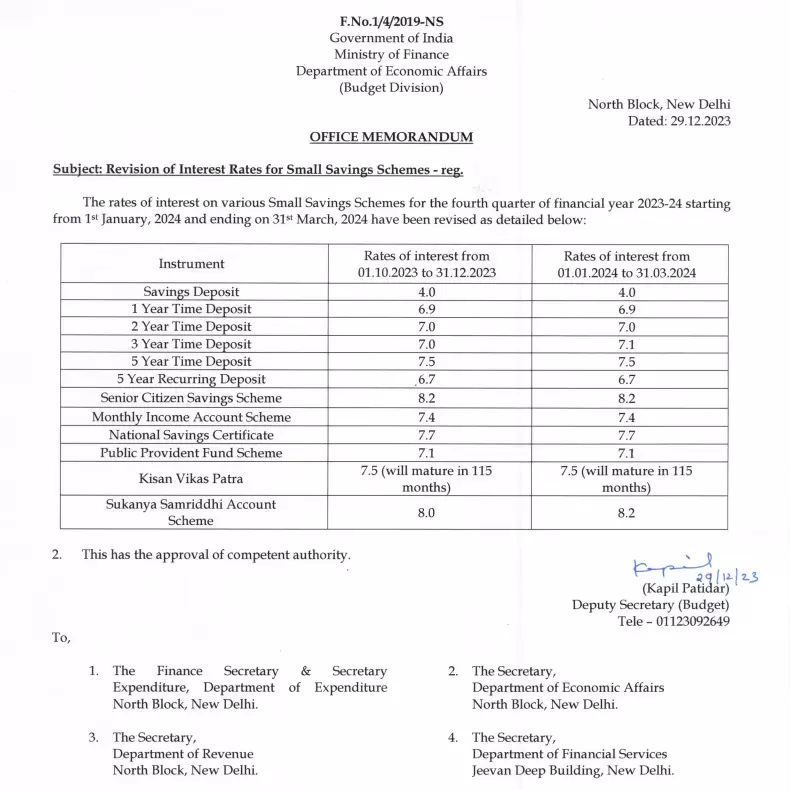

On Friday, December 29, the government disclosed the interest rates for small savings schemes in the upcoming January-March 2024 quarter. Notably, Sukanya Samriddhi Yojana witnesses a 0.20% increase, while 3-year time deposit rates see a 0.10% uptick. However, there are no changes in the rates of other schemes.

Sukanya Samriddhi Yojana (SSY) is a scheme launched by the government in 2015 as a part of the Beti Bachao Beti Padhao campaign to encourage girls to save for their future. It is a fixed-income investment through which you can deposit money regularly and earn interest on it.

You can also claim a tax deduction of up to ₹1.5 lakh in a financial year under Section 80C of the Income Tax Act using the Sukanya Samriddhi Yojana. (If you are paying tax)

Government Announces Small Savings Scheme Interest Rates for January-March 2024 Quarter

This announcement follows a similar pattern from September 29, when the government raised RD rates by 0.20% for the October-December period. Previously, the interest rates for Sukanya Scheme and three-year time deposits stood at 8% and 7%, respectively. Impressively, this marks the sixth consecutive quarter witnessing increments in the rates of these particular schemes.

No Change in Interest Rates for Selected Schemes

The Finance Ministry’s recent circular outlines the interest rates for various small savings schemes from January 1, 2024, to March 31, 2024. While some schemes remain unchanged, others see adjustments.

Interest Rates for Different Schemes:

- Savings Deposits: 4%

- 1-Year Time Deposit: 6.9%

- 2-Year Time Deposit: 7%

- 5-Year Time Deposit: 7.5%

- 5-Year Recurring Deposits: 6.7%

- National Savings Certificate: 7.7%

- Kisan Vikas Patra: 7.5% (Matures in 115 months)

- Senior Citizen Saving Scheme: 8.2%

- Post Office Monthly Income Account Scheme: 7.4%

PPF Investors Face Disappointment: No Change Since April 2020

Despite adjustments in various schemes, the Public Provident Fund (PPF) sees no change in its interest rate, maintaining a steady 7.1%. This lack of adjustment has persisted since April 2020, causing disappointment among PPF investors.

Sukanya Samriddhi Yojana (SSY) 2024

| Key Features of Sukanya Samriddhi Yojana (SSY) | |

|---|---|

| Interest Rate | 8.20% per annum |

| Minimum Investment | Rs. 250 per annum |

| Maximum Investment | Rs. 1.5 lakh per annum |

| Maturity Period | When the girl turns 21 years old or after 18 years at the time of marriage |

| Eligibility to the age limit | Girls must be 10 years of age or below |

Some Important Features of Sukanya Samriddhi Yojana Account

- Interest rate: The government fixes the rate of Sukanya Samriddhi Yojana every three months. The government has fixed the new rate of this scheme at 8.20% before the start of the new year 2024. This interest is paid at the time of maturity.

- Deposit Amount: You can invest a minimum of Rs 250 per year in this scheme. And the maximum you can invest is 1.5 lakh rupees. In this scheme, you can pay as often as you want. But if you fail to pay the minimum amount, your account will be closed and you will have to pay Rs 100 to activate it.

- Lock-in period: Sukanya Samriddhi Yojana has a lock-in period of 21 years. For example: If the girl child is 3 years old at the time of initiation of this scheme, the maturity date will be when the girl child turns 24 years old.

- Transfer of accounts: If your residential address changes, you can transfer your Sukanya Samriddhi account to any post office or bank branch. Just need to provide proof of new address. If transferring the account for some other reason, you will have to pay a fee of Rs.100.

The number of accounts: Only one account can be opened in the name of a girl. And you can open a maximum of two accounts in one house. But you can open more than two accounts if three girls are born at the same time or if first one girl is born and then two twins are born.

Read This

Sukanya Samriddhi Yojana Account Eligibility Criteria

If the account is opened in the name of a girl child

- Sukanya Samriddhi’s Account can be opened by a girl

- The age of the girl should be a maximum of 10 years but the government has given an extra period of one year (Grace Period).

- Girls only have to submit age proof. (Age Proof)

If you are opening the account on behalf of a girl

- You can open this account on behalf of your daughter only if you are the parent or legal guardian of the girl.

- Each parent or legal guardian can open a maximum of two accounts.

Benefits of Sukanya Samriddhi Yojana Account

- It is a government scheme that offers guaranteed returns. Recently the government has announced new rates for Sukanya Samriddhi Yojana. The current rate offers an annual return of 8.20%, which is higher than all other government schemes.

- You can also claim a tax deduction of up to ₹1.5 lakh in a financial year under Section 80C of the Income Tax Act using the Sukanya Samriddhi Yojana. (If you are paying tax)

- If you have a daughter at home, you can choose this investment option, as you can get a fixed return on your investment. Humaturity amount can be used for a girl’s education or marriage.

- You must spend at least Rs. 250 can open Sukanya Samriddhi account. Also, you need to deposit at least Rs.250 every year to keep your account active. It is an affordable alternative to chains.

How to withdraw money from the Sukanya Samriddhi Yojana Account?

1. Maturity Withdrawal: After completing 21 years you can withdraw money without paying any tax. For this, you need a withdrawal form, ID proof, resident proof, etc. Documents have to be submitted.

2. Partial Withdrawals (up to 50%): Money can be withdrawn for a girl’s education or marriage. If wanted for education, girls should be 18 years of age and should have completed class 10.

3. Premature Account Closure: In case of withdrawal before completion of the plan, there are some conditions as follows

- If a girl turns 18 and getting married then you can apply for withdrawal one month before or 3 months after marriage. 50% of the withdrawal amount is tax-free.

- In case of the death of the daughter, the death certificate has to be submitted while withdrawing the money and all the money will be given to the parent.

- If the girl is changing her residence and closing the account then submit the same documents like a resident certificate etc.

- Sukanya Samriddhi’s Account has been for 5 years but now it is difficult to pay further due to the lack of income of her parents, the illness of her daughter, etc.

4. Interest on Premature Closure: If you close the Sukanya Samriddhi account for any reason other than this, you will get the same return on this scheme as the interest you get on the post office account.

How to open Sukanya Samriddhi Account? (How to open a Sukanya Samriddhi Account)

Now that you have got all the information about Sukanya Samriddhi Account, understand how to open it.

Step 1: Visit the nearest post office or bank branch

Step 2: Fill out the account opening form and submit KYC documents

Step 3: Deposit the first amount of Rs 250 (Cheque, Cash, or Demand Draft)

Step 4: You will be given a passbook once the account is opened.

Documents required for Sukanya Samriddhi Yojana

What is required to open a Sukanya Samriddhi account?

- Identity Card of Parents

- Daughter’s Aadhar Card

- The Bank account passbook was opened in the daughter’s name

- Passport size photo of daughter 5. Mobile number

What is the minimum amount of Sukanya Samriddhi Yojana 2024?

Rs 250 is enough to open a Sukanya Samriddhi Yojana account, but later money can also be deposited in multiples of Rs 100. A minimum deposit of Rs 250 has to be made in any financial year. An amount of more than Rs 1.5 lakh cannot be deposited in the SSY account at one time or multiple times in any one financial year.

Money can be deposited in Sukanya Samriddhi Yojana Calculator 2024 account for 15 years from the date of account opening. In the case of a 9-year-old girl, the amount can be deposited till she turns 24. As long as the girl’s age is 24 to 30 years, interest will continue to be earned on the amount deposited in the account when it matures.