Housing And Urban Development Corp Ltd (NSE: HUDCO) Share Price: hudco share has increased by +21.85 (19.17%) in 1 day and reached all time high of 136.40. When everyone came to know that an order worth ₹ 14,500 crore had been received from the Gujarat government.

Housing And Urban Development Corp Ltd has signed an MOU with the state of Gujarat, which will invest Rs 14500 crore for financing the Housing and Urban Infrastructure projects in Gujarat, this information has been given by Chairman and Managing Director Sanjay Kulshrestha.

HUDCO Chairman and Managing Director Sanjay Kulshrestha and Gujarat government MoU 14,500 cr

Housing and Urban Development Corp. (HUDCO) has entered into a significant partnership with the Gujarat government, formalized through a Memorandum of Understanding (MoU). The agreement, worth up to Rs 14,500 crore, aims to fuel housing and urban infrastructure projects within the state.

HUDCO Chairman and Managing Director, Sanjay Kulshrestha, inked the MoU alongside state officials, with Chief Minister Bhupendra Patel in attendance. This collaboration underscores HUDCO’s commitment to supporting the development goals of Gujarat.

The MoU outlines HUDCO’s pledge to invest up to ₹14,500 Crore in financing housing and urban infrastructure projects in Gujarat. The State Government of Gujarat, in alignment with its broader development vision, seeks to implement diverse projects that contribute to the overall progress of the state.

HUDCO, functioning as a techno-financial institution, specializes in providing financial assistance for housing and urban development projects across India. Its pivotal role extends to addressing the diverse needs of all sectors, contributing significantly to the social and economic fabric of the nation.

Expressing its interest, HUDCO intends to execute the MoU by extending financial assistance, in the form of term loans, to the State Government of Gujarat. This move aligns with HUDCO’s objectives and guidelines under the Financial Services Sector.

Inviting Investments for ‘Vibrant Gujarat Summit 2024’

In preparation for the upcoming ‘Vibrant Gujarat Summit 2024‘ in January, the state government has actively sought proposals for investments from banking and financial services institutions. This initiative underscores Gujarat’s commitment to fostering housing and infrastructure development, setting the stage for collaborative growth.

This strategic collaboration between HUDCO and the Gujarat government marks a significant step towards realizing the state’s developmental aspirations.

Housing And Urban Development Corp Ltd (NSE: HUDCO) Share Price

Today, HUDCO’s stock price exhibited a bullish trend by opening on the upside and reaching a new all-time high of ₹135.90 per share within a few hours of the stock market’s opening. This surge represented an impressive intraday gain of over 19.21%. The shares of Housing and Urban Development Corporation Ltd have consistently followed an upward trajectory since the beginning of 2023.

In the year-to-date (YTD) timeframe, the HUDCO share price has experienced substantial growth, climbing from approximately ₹53.50 to ₹135.65 per share. This remarkable performance translates to a remarkable 150% return for investors holding positions in the company.

Read More:

Bharat Agri Fert & Realty Share price target 2024, 2025, 2026, 2027, 2030, 2035, 2040, 2045, 2050

BHEL Share Price Target 2023, 2024, 2025, 2026, 2027, 2030, 2035, 2040, 2050

About HUDCO

HUDCO, short for the Housing and Urban Development Corporation Limited, is an Indian public sector entity specializing in housing finance and infrastructure project financing. It was established on April 25, 1970, and is headquartered in New Delhi. As of 2023, HUDCO has a workforce of 673 employees. In the fiscal year 2020, the corporation reported a revenue of 7,571.64 crores INR (equivalent to US$950 million).

HUDCO Limited – Fundamental Analysis

HUDCO Limited Share: Last 5 Years’ Financial Condition

To enhance our comprehension of the market performance, let’s examine the historical outlook of this share in previous years. Nevertheless, investors should exercise caution by considering the associated risks and prevailing market conditions before making any investment decisions.

Last 5 Years’ Sales:

| PARTICULARS | SEP 2019 | DEC 2020 | MAR 2021 | JUN 2022 | SEP 2023 |

|---|---|---|---|---|---|

| Net Sales | 5,548 | 7,532 | 7,235 | 6,954 | 7,049 |

Last 5 Years’ Net Profit:

| 2019 | 2020 | 2021 | 2022 | 2023 | |

| Net Profit | 1,180 | 1,708 | 1,579 | 1,716 | 1,701 |

Last 5 Years’ Profit Growth Ratios

Profit Growth:

- 1-Year: –

- 3-Year:

- 5-Year:

Last 5 years’ Return on Equity (ROE)

- 1-Year:

- 3-Year:

- 5-Year:

HUDCO Limited Share peer’s company

- LIC Housing Finance

- PNB Housing Finance

- Aptus Value Housing

- Aavas Financiers

- Indiabulls Housing

Future of HUDCO Share Price

Risk of HUDCO Share

HUDCO Share Price Summary

Tirth Plastic 52 Week Low and 52 Week High, Bharat Agri Fert & Realty Share’s all-time high of 136.90 rs.

| Metric | Value |

|---|---|

| Market Cap | 26.98 TCr |

| P/E Ratio | 15.06 |

| Dividend Yield | 2.86% |

| 52-week High | 136.40 |

| 52-week Low | 40.40 |

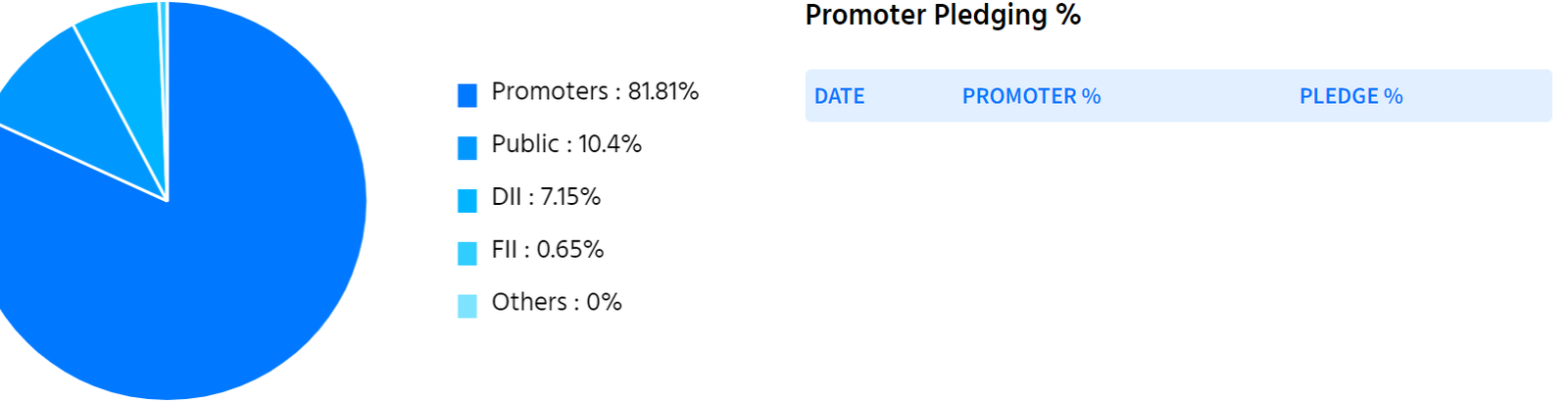

Shareholding Pattern Of HUDCO share

| Summary | 2024 |

|---|---|

| Promoter | 81.81% |

| FII | 0.65% |

| DII | 7.15% |

| Public | 10.4% |

Should You Invest In HUDCO Ltd Shares?

Conclusion

This article serves as a comprehensive guide to the HUDCO Share Price target.

The information and forecasts are derived from our analysis, research, company fundamentals, historical data, experiences, and various technical analyses. The article delves into the share’s prospects and growth potential in detail.

Feel free to comment below if you have any further queries. We are more than happy to address all your questions. If you find this information helpful, consider sharing the article with as many people as possible.

Disclaimer:

Dear readers, please be advised that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided on this site is solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Additionally, share price predictions are intended for reference purposes only and are valid only under positive market conditions.

This study does not consider any uncertainties regarding the company’s future or the current market conditions. While this information is for informational purposes, we disclaim any responsibility for potential financial losses incurred based on the information provided on this site. We aim to offer timely updates about the stock market and financial products to assist you in making informed investment decisions. It is crucial to conduct your research before making any investment decisions.