Tata Motors (NSE: TATAMOTORS) share price: Tata Motors share has doubled in 1 year, and has given a return of +391.45 (100.90%), Tata Motors share price was Rs 394 on January 1, 2023, which increased by 100% to Rs 802.90 on December 2023, which is 52 weeks high.

Tata shares have increased by +61.95 (8.63%) in the last 5 days.

Tata Motors shares reached an all-time high on Friday, 802.90 price was reached.

Tata Motors has received an order for a 1,350 Tata LPO 1618 diesel bus chassis, designed for intercity and long-distance travel, from Uttar Pradesh State Road Transport Corporation.

Tata Motors Secures Prestigious Order for 1,350 Units of Tata LPO 1618 Diesel Bus Chassis from UPSRTC

Tata Motors order 1350 bus chassis from Uttar Pradesh State Road Transport Corporation.

Tata Motors, India’s leading commercial vehicle manufacturer, has successfully clinched a significant contract from the Uttar Pradesh State Road Transport Corporation (UPSRTC). The order entails the supply of 1,350 units of the Tata LPO 1618 diesel bus chassis designed for intercity and long-distance travel. Notably, the Tata LPO 1618 adheres to BS6 emission standards, ensuring superior performance, excellent passenger comfort, and an industry-leading total cost of ownership (TCO).

The competitive e-bidding process, conducted through the Government tendering system, played a pivotal role in Tata Motors securing this substantial order. The phased delivery of the bus chassis is part of the contractual agreement.

Tata Motors has consistently led the way in providing advanced buses and public transportation solutions across various cities and states in India. With a track record of supplying over 58,000 buses to multiple state and public transport undertakings, the company continues to contribute to the seamless connectivity of cities and towns, offering comfortable travel options to the public.

Tata Motors Share Price Target 2024, 2025, 2030

Tata Motors Share Price Target 2023 ₹801, 2024 ₹900, 2025 ₹1000.50, 2026 ₹1200.50, 2027 ₹1700.50, 2028 ₹2000.50, To 2030 ₹3000.50

Also Read

About Tata Motors

Tata Motors Limited, a prominent entity within the USD 128 billion Tata Group, stands as a distinguished global automobile manufacturer. As a USD 42 billion organization, Tata Motors takes the lead in producing a diverse array of vehicles, including cars, utility vehicles, pick-ups, trucks, and buses. The company is renowned for offering an extensive range of integrated, smart, and e-mobility solutions, contributing to its status as a key player in the automotive industry.

Pioneering Mobility Solutions with ‘Connecting Aspirations’

At the heart of Tata Motors’ brand promise is the commitment to ‘Connecting Aspirations.’ In India, the company holds a leading position in the commercial vehicles segment and ranks among the top three in the passenger vehicles market. Tata Motors consistently aims to captivate the imagination of the next generation of customers by introducing new products. Fueled by state-of-the-art design and research and development centers in India, the UK, the US, Italy, and South Korea, the company remains at the forefront of innovation.

Driving the Future of Mobility

Tata Motors focuses on engineering and technology-enabled automotive solutions that align with the future of mobility. The company’s innovation efforts are centered on developing pioneering technologies that are both sustainable and tailored to evolving market dynamics and customer aspirations. As a trailblazer in India’s Electric Vehicle (EV) transition, Tata Motors actively contributes to the shift towards sustainable mobility solutions. The company’s strategic approach leverages the synergy between Group companies and involves active collaboration with the Government of India to shape the policy framework.

Global Presence and Operations

With a significant presence in India, the UK, South Korea, Thailand, South Africa, and Indonesia, Tata Motors markets its vehicles across Africa, the Middle East, Latin America, Southeast Asia, and the SAARC countries. As of March 31, 2023, Tata Motors’ operations encompass 88 consolidated subsidiaries, two joint operations, three joint ventures, and numerous equity-accounted associates. The company exercises significant influence over these entities, solidifying its standing as a dynamic force in the global automotive landscape.

For Media Inquiries, Please Contact: Tata Motors Corporate Communications: +91 22-66657613 / indiacorpcomm@tatamotors.com

Tata Motors Limited – Fundamental Analysis

Tata Motors Limited Share: Last 5 Years’ Financial Condition

To enhance our comprehension of the market performance, let’s examine the historical outlook of this share in previous years. Nevertheless, investors should exercise caution by considering the associated risks and prevailing market conditions before making any investment decisions.

Last 5 Years’ Sales:

| PARTICULARS | March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

|---|---|---|---|---|---|

| Net Sales | 69,202.76 | 43,928.17 | 30,175.03 | 30,175.03 | 65,757.33 |

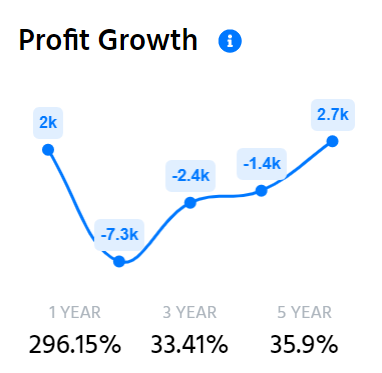

Last 5 Years’ Net Profit:

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Net Profit | 2,020.60 | -7,289.63 | -2,395.44 | -1,390.86 | 2,728.13 |

Tata Motors Last 5 Years’ Profit Growth Ratios

Profit Growth:

- 1-Year: 296.15%

- 3-Year: 33.41%

- 5-Year: 33.41%

Tata Motors Last 5 years’ Return on Equity (ROE)

- 1-Year: 12.9%

- 3-Year: -2.87%

- 5-Year: -7.16%

Tata Motors Limited Share peer’s company

- Ashok Leyland

- Olectra Greentech

- Force Motors

- SML Isuzu

Future of Tata Motors Share Price

Risk of Tata Motors Share

Revenue Growth Performance:

- The company has demonstrated sluggish revenue growth, registering only 14.39% over the past three years.

Return on Equity (ROE):

- The ROE for the company has been unfavorable, standing at -2.87% over the past three years.

Return on Capital Employed (ROCE):

- The ROCE for the company also reflects suboptimal performance, recording a low figure of 2.86% over the past three years.

Tax Rate Anomaly:

- An unusual tax rate is observed, marked by a low value of -117.42%, requiring further investigation.

High Price-to-Earnings (PE) Ratio:

- The company is currently trading at a notably high PE ratio of 58.80, indicating potential overvaluation.

Elevated EV/EBITDA Ratio:

- The company’s EV/EBITDA ratio is on the higher side at 33.66, suggesting a comparatively elevated valuation of its earnings before interest, taxes, depreciation, and amortization.

Tata Motors Share Price Summary

Tata Motors 52 Week Low and 52 Week High, Tata Motor’s all-time high of 802.90 rs.

| Metric | Value |

|---|---|

| Open | 755.00 |

| High | 802.90 |

| Low | 754.00 |

| Market Cap | ₹2.86 LCr |

| P/E Ratio | 16.41 |

| Dividend Yield | 0.26% |

| CDP Score | B |

| 52-Week High | 802.90 |

| 52-Week Low | 381.00 |

Shareholding Pattern Of Tata Motors share

| Share Holding | 2024 |

|---|---|

| Promoter | 46.38% |

| FII | 18.4% |

| DII | 17.52% |

| Public | 17.7% |

Should You Invest In Tata Motors Ltd Shares?

Profit Growth Performance:

- Over the past three years, the company has demonstrated commendable profit growth, achieving a substantial 33.41%.

PEG Ratio Assessment:

- The company’s PEG ratio is notably low at 0.23, suggesting a potentially attractive valuation relative to its earnings growth.

Efficient Cash Conversion Cycle:

- The company exhibits an efficient Cash Conversion Cycle, with a negative value of -18.14 days, indicating swift conversion of invested resources into cash.

Strong Operating Leverage:

- Demonstrating a robust degree of operating leverage, the average Operating Leverage for the company stands at a significant 6.28. This underscores the company’s ability to amplify its operating income through efficient cost management.

Conclusion

This article serves as a comprehensive guide to the Tata Motors Share Analytics.

The information and forecasts are derived from our analysis, research, company fundamentals, historical data, experiences, and various technical analyses. The article delves into the share’s prospects and growth potential in detail.

Feel free to comment below if you have any further queries. We are more than happy to address all your questions. If you find this information helpful, consider sharing the article with as many people as possible.

Disclaimer:

Dear readers, please be advised that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided on this site is solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Additionally, share price predictions are intended for reference purposes only and are valid only under positive market conditions.

This study does not consider any uncertainties regarding the company’s future or the current market conditions. While this information is for informational purposes, we disclaim any responsibility for potential financial losses incurred based on the information provided on this site. We aim to offer timely updates about the stock market and financial products to assist you in making informed investment decisions. It is crucial to conduct your research before making any investment decisions.