You can decide whether to buy or sell IRCON’s stock. IRCON shares future predictions for 2025, 2030, 2035, and 2050.

nse: IRCON Share Price Target’s share has increased by +40.15

IRCON Share Price Target 2024, 2025, 2026, 2027, 2028, 2030, 2035, 2040, 2050

IRCON Share Price Target 2025

Based on analysis by stock experts, The share price range is set at ₹250 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹351.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2025 | ₹250 | ₹351 |

IRCON Share Price Target 2026

Based on analysis by stock experts, The share price range is set at ₹600 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹700.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2026 | ₹600 | ₹700 |

IRCON Share Price Target 2027

Based on analysis by stock experts, The share price range is set at ₹800 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹900.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2027 | ₹800 | ₹900 |

IRCON Share Price Target 2028

Based on analysis by stock experts, The share price range is set at ₹1000 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹1200.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2030 | ₹1000 | ₹1200 |

Read More

IRFC Share Price Target 2024, 2025, 2026, 2030, 2035, 2040, 2045, 2050

RVNL share price Target 2024, 2025, 2026, 2027, 2028, 2030, 2035, 2040, 2045, 2050

Jupiter Wagons Share price target 2024, 2025, 2026, 2027, 2030, 2035, 2040, 2045, 2050

IRCON Share Price Target 2030

Based on analysis by stock experts, The share price range is set at ₹2000 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹2100.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2030 | ₹2000 | ₹2100 |

IRCON Share Price Target 2035

Based on analysis by stock experts, The share price range is set ₹3000 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹4000

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2035 | ₹3000 | ₹4000 |

IRCON Share Price Target 2040

Based on analysis by stock experts, The minimum target price for IRCON is set at ₹5500, while the mid-year maximum target price is projected to be ₹6000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2040 | ₹5500 | ₹6000 |

IRCON Share Price Target 2045

Based on analysis by stock experts, The share price range is set at ₹8000 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹9000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2045 | ₹8000 | ₹9000 |

IRCON Share Price Target 2050

Based on analysis by stock experts, The share price range is set at ₹12000 as the minimum, while after the year, the maximum target price for IRCON shares is expected to be ₹13,000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2050 | ₹12000 | ₹13000 |

| Years | 1st Targets (₹) | 2nd Targets (₹) |

| 2024 | ₹205 | ₹250 |

| 2025 | ₹300 | ₹400 |

| 2026 | ₹600 | ₹700 |

| 2027 | ₹800 | ₹900 |

| 2028 | ₹1000 | ₹1200 |

| 2030 | ₹2000 | ₹2100 |

| 2035 | ₹3000 | ₹4000 |

| 2040 | ₹5500 | ₹6000 |

| 2045 | ₹8000 | ₹9000 |

| 2050 | ₹12000 | ₹13000 |

About IRCON Ltd

ircon.org is the official website of Ircon International, also known as Indian Railway Construction International Limited. It is an Indian engineering and construction corporation that specializes in transport infrastructure. This public sector undertaking was founded on April 27, 1976, by the Indian Railways under the Indian Companies Act of 1956. The company is headquartered in India and has a workforce of 968 employees as of 2023. In 2020, Ircon International reported a revenue of 5,441.72 crores INR (equivalent to US$680 million). Additionally, the company has subsidiaries, including the Indian Railway Stations Development Corporation. For more detailed information, you can visit their official website at ircon.org.

IRCON Limited – Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹ 19,501.59 Cr. |

| Enterprise Value | ₹ 14,716.27 Cr. |

| No. of Shares | 94.05 Cr. |

| P/E | 22.48 |

| P/B | 3.57 |

| Face Value | ₹ 2 |

| Div. Yield | 1.48 % |

| Book Value (TTM) | ₹ 58.10 |

| Cash | ₹ 4,785.32 Cr. |

| Debt | ₹ 0 Cr. |

| Promoter Holding | 65.17 % |

| EPS (TTM) | ₹ 9.23 |

| Sales Growth | 43.57% |

| ROE | 15.85 % |

| ROCE | 21.89% |

| Profit Growth | 42.72% |

To enhance our comprehension of the market performance, let’s examine the historical outlook of this share in previous years. Nevertheless, investors should exercise caution by considering the associated risks and prevailing market conditions before making any investment decisions.

Last 5 Years’ Sales:

| PARTICULARS | March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

|---|---|---|---|---|---|

| Net Sales | 4,415.10 | 5,202.06 | 4,955.93 | 6,910.15 | 9,921.20 |

Last 5 Years’ Net Profit:

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

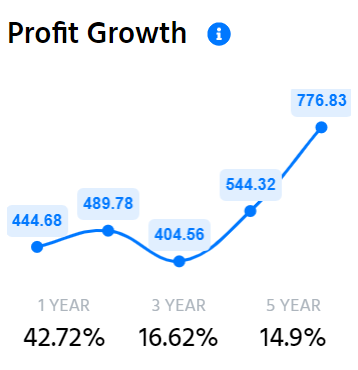

| Net Profit | 444.68 | 489.78 | 404.56 | 544.32 | 776.83 |

IRCON Ltd’s Last 5 Years’ Profit Growth Ratios

Profit Growth:

- 1-Year: 42.72%

- 3-Year: 16.62%

- 5-Year: 14.9%

IRCON Ltd Last 5 years’ Return on Equity (ROE)

- 1-Year: 15.85%

- 3-Year: 12.45%

- 5-Year: 12.2%

IRCON Limited Share peer’s company

- Larsen & Toubro

- GMR Airports Infra.

- Rail Vikas Nigam

- GR Infraprojects

- Kalpataru Projects

Future of IRCON Ltd Share Price

The stock price of Ircon International Ltd plays a pivotal role in evaluating the company’s potential for growth. For investors with a long-term perspective, a critical analysis of Ircon International Ltd’s historical stock price trends is imperative.

Sales Growth: Ircon International has demonstrated a commendable revenue growth of 43.57%, aligning well with its overall growth and performance.

Operating Margin: This metric provides insights into the company’s operational efficiency. Ircon International’s operating margin for the current financial year stands at 3.38%.

Dividend Yield: This metric indicates the dividend received relative to the stock price. In the current year, Ircon International has a dividend of Rs 3, with a yield of 1.47%.

Risk of IRCON Ltd Share

The company bears contingent liabilities amounting to 2,393.81 Cr.

The company experiences a negative cash flow from operations, totaling -119.90.

The tax rate is relatively low, standing at 12.04%.

IRCON Ltd Share Price Summary

Jupiter Wagons Ltd 52 Week Low and 52 Week High, Jupiter Wagons Ltd’s all-time high of 209.70 rs.

| Metric | Value |

|---|---|

| Open | 202.90 |

| High | 204.80 |

| Low | 199.90 |

| Market Cap | 19.26TCr |

| P/E Ratio | 21.76 |

| Dividend Yield | 1.47% |

| 52-week High | 209.70 |

| 52-week Low | 50.10 |

Shareholding Pattern Of IRCON share

| Summary | 2024 |

|---|---|

| Promoter | 65.17% |

| FII | 4.11% |

| DII | 1.2% |

| Public | 29.52% |

Should You Invest In IRCON Shares?

The company has demonstrated a robust profit growth of 16.62% over the last 3 years.

The company has achieved significant revenue growth of 24.01% over the last 3 years.

The company operates with virtually no debt.

The company’s PEG ratio is 0.53.

The company maintains an efficient Cash Conversion Cycle of -721.78 days.

The company boasts a substantial promoter holding of 65.17%.

Conclusion

This article serves as a comprehensive guide to the Ircon International Share Price target. The information and forecasts are derived from our analysis, research, company fundamentals, historical data, experiences, and various technical analyses. The article delves into the share’s prospects and growth potential in detail. Feel free to comment below if you have any further queries. We are more than happy to address all your questions. If you find this information helpful, consider sharing the article with as many people as possible.

Disclaimer:

Dear readers, please be advised that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided on this site is solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Additionally, share price predictions are intended for reference purposes only and are valid only under positive market conditions.

This study does not consider any uncertainties regarding the company’s future or the current market conditions. While this information is for informational purposes, we disclaim any responsibility for potential financial losses incurred based on the information provided on this site. We aim to offer timely updates about the stock market and financial products to assist you in making informed investment decisions. It is crucial to conduct your research before making any investment decisions.