From here you can know whether Jupiter Wagons’s stock should be bought or sold. Jupiter Wagons shares future predictions for 2023, 2024, 2025, 2030, 2035, and 2050.

nse: Jupiter Wagons Share Price Target’s share has increased by +282.30

Jupiter Wagons Share Price Target 2024, 2025, 2026, 2027, 2028, 2030, 2035, 2040, 2050

Jupiter Wagons Share Price Target 2024

Based on analysis by stock experts, The share price range is set at ₹390 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹450

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2024 | ₹390 | ₹450 |

Jupiter Wagons Share Price Target 2025

Based on analysis by stock experts, The share price range is set at ₹500 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹530.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2025 | ₹500 | ₹530 |

Jupiter Wagons Share Price Target 2026

Based on analysis by stock experts, The share price range is set at ₹600 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹700.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2026 | ₹600 | ₹700 |

Jupiter Wagons Share Price Target 2027

Based on analysis by stock experts, The share price range is set at ₹800 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹900.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2027 | ₹800 | ₹900 |

Jupiter Wagons Share Price Target 2028

Based on analysis by stock experts, The share price range is set at ₹1000 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹1200.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2030 | ₹1000 | ₹1200 |

Read More

-

IRFC Share Price Target 2024, 2025, 2026, 2030, 2035, 2040, 2045, 2050

-

RVNL share price Target 2024, 2025, 2026, 2027, 2028, 2030, 2035, 2040, 2045, 2050

Jupiter Wagons Share Price Target 2030

Based on analysis by stock experts, The share price range is set at ₹2000 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹2100.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2030 | ₹2000 | ₹2100 |

Jupiter Wagons Share Price Target 2035

Based on analysis by stock experts, The share price range is set ₹3000 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹4000

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2035 | ₹3000 | ₹4000 |

Jupiter Wagons Share Price Target 2040

Based on analysis by stock experts, The minimum target price for Jupiter Wagons is set at ₹5500, while the mid-year maximum target price is projected to be ₹6000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2040 | ₹5500 | ₹6000 |

Jupiter Wagons Share Price Target 2045

Based on analysis by stock experts, The share price range is set at ₹11500 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹13500.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2045 | ₹11,500 | ₹13,500 |

Jupiter Wagons Share Price Target 2050

Based on analysis by stock experts, The share price range is set at ₹20,000 as the minimum, while after the year, the maximum target price for Jupiter Wagons shares is expected to be ₹21,000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2050 | ₹20000 | ₹21000 |

| Years | 1st Targets (₹) | 2nd Targets (₹) |

| 2024 | ₹390 | ₹450 |

| 2025 | ₹500 | ₹530 |

| 2026 | ₹600 | ₹700 |

| 2027 | ₹800 | ₹900 |

| 2028 | ₹1000 | ₹1200 |

| 2030 | ₹2000 | ₹2100 |

| 2035 | ₹3000 | ₹4000 |

| 2040 | ₹5500 | ₹6000 |

| 2045 | ₹11500 | ₹13500 |

| 2050 | ₹20000 | ₹21000 |

About Jupiter Wagons Ltd

Jupiter Wagons Limited is an Indian private manufacturing company specializing in the production of railway freight wagons, passenger coaches, wagon components, cast manganese steel crossings, and castings. The company is headquartered in Kolkata, West Bengal, and produces coaches for both the Indian Railways and various private entities.

Founded on 28 July 1979, the company has grown to employ 877 individuals as of 2023. With a revenue of 2,073.33 crores INR (equivalent to US$260 million in 2023), Jupiter Wagons Limited has established subsidiaries such as JWL Talegria (India) Private Limited and Habitation Realestate LLP. The company continues to be a key player in the railway manufacturing industry. Visit cebbco.com for more information.

Jupiter Wagons Limited – Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹15,844.44 Cr. |

| Enterprise Value | ₹15,966.04 Cr. |

| No. of Shares | 41.23 Cr. |

| P/E | 68.2 |

| P/B | 10.85 |

| Face Value | ₹10 |

| Dividend Yield | 0.13% |

| Book Value (TTM) | ₹35.40 |

| Cash | ₹166.07 Cr. |

| Debt | ₹287.67 Cr. |

| Promoter Holding | 72.37% |

| EPS (TTM) | ₹5.64 |

| Sales Growth | 75.52% |

| ROE (Return on Equity) | 16.81% |

| ROCE (Return on Capital Employed) | 24.40% |

| Profit Growth | 150.60% |

To enhance our comprehension of the market performance, let’s examine the historical outlook of this share in previous years. Nevertheless, investors should exercise caution by considering the associated risks and prevailing market conditions before making any investment decisions.

Last 5 Years’ Sales:

| PARTICULARS | March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

|---|---|---|---|---|---|

| Net Sales | 215.80 | 125.74 | 995.75 | 1,178.35 | 2,068.25 |

Last 5 Years’ Net Profit:

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Net Profit | 88.67 | -0.14 | 53.50 | 50.03 | 125.38 |

Jupiter Wagons Ltd’s Last 5 Years’ Profit Growth Ratios

Profit Growth:

- 1-Year: 150.6%

- 3-Year: 865.3%

- 5-Year: 40.1%

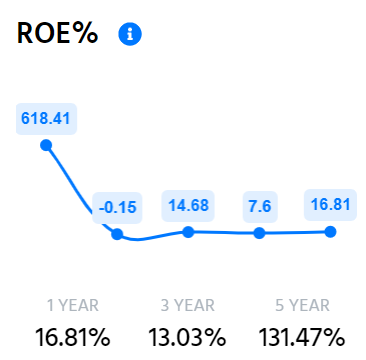

Jupiter Wagons Ltd Last 5 years’ Return on Equity (ROE)

- 1-Year: 16.81%

- 3-Year: 13.03%

- 5-Year: 131.47%

Jupiter Wagons Limited Share peer’s company

- Sona BLW Precision

- ZF Comm Vehic Contr

- Endurance Tech

- JBM Auto

- TVS Holdings

Future of Jupiter Wagons Ltd Share Price

The Indian Auto Industry ranks among the top 5 largest auto industries globally. India is a significant auto exporter with robust growth expectations for exports shortly. Government support is bolstering the development of auto companies, but the question remains: will this support be sustained?

The primary revenue source for the Auto Sector is sales, and Jupiter Wagons has reported an impressive sales growth of 75.52%, reaching Rs 879.30 Cr in the latest quarter. To assess whether the company’s inventory is effectively sold and the sales picture is accurate, the inventory turnover ratio is crucial. Jupiter Wagons’ ratio stands at 5.10 times, indicating poor inventory management.

Jupiter Wagons has shown a remarkable profit growth of 150.60% over the year, with the latest year’s profit at Rs 125.38 Cr compared to the previous year’s Rs 50.03 Cr. Anticipated new permits and increasing demand are expected to contribute to further profit growth in the coming year.

In the latest quarter, Jupiter Wagons’ operating profit is Rs 121.17 Cr, providing insight into the company’s operational performance, crucial for making financing decisions.

With an average Return on Equity (ROE) of 16.81%, Jupiter Wagons’ financial health is notable. Given the high equity investments and substantial debt required for research and manufacturing, the low Debt to Equity ratio of 0.36 is positive.

Jupiter Wagons pays a dividend of Rs 0.50 per share, indicating a reluctance to share profits with shareholders. The low dividend yield of 0.13% supports this stance.

Promoters hold a significant stake in Jupiter Wagons at 72.37%, with no pledging observed.

The market’s valuation of the company’s earnings is reflected in the Price to Earnings (PE) multiple. Jupiter Wagons’ current PE is 68.20, notably higher than the 5-year average PE of 15.07, suggesting a potentially optimistic market sentiment.

Risk of Jupiter Wagons Ltd Share

The company is trading at a high EV/EBITDA of 39.82.

Jupiter Wagons Ltd Share Price Summary

Jupiter Wagons Ltd 52 Week Low and 52 Week High, Jupiter Wagons Ltd’s all-time high of 390.45 rs.

| Metric | Value |

|---|---|

| Open | 381.00 |

| High | 390.45 |

| Low | 361.40 |

| Market Cap | 15.33TCr |

| P/E Ratio | – |

| Dividend Yield | – |

| 52-week High | 390.45 |

| 52-week Low | 361.40 |

Shareholding Pattern Of Jupiter Wagons share

| Summary | 2024 |

|---|---|

| Promoter | 72.37% |

| FII | 0.86% |

| DII | 1% |

| Public | 25.76% |

Should You Invest In Jupiter Wagons Shares?

The company has demonstrated a commendable profit growth of 865.30% over the past three years. Additionally, it has achieved substantial revenue growth, recording a 154.31% increase over the same period. The company maintains a robust Interest Coverage Ratio of 8.10, indicating a healthy ability to meet its interest obligations.

With a PEG ratio of 0.45, the company’s stock valuation to its earnings and growth rate is considered favorable. Furthermore, the company exhibits an efficient Cash Conversion Cycle, completing the cycle in 57.00 days, reflecting effective management of working capital.

A noteworthy aspect is the company’s high promoter holding, standing at 72.37%, underscoring strong promoter confidence and involvement in the company’s affairs.

Conclusion

This article serves as a comprehensive guide to the Jupiter Wagons Share Price target. The information and forecasts are derived from our analysis, research, company fundamentals, historical data, experiences, and various technical analyses. The article delves into the share’s prospects and growth potential in detail. Feel free to comment below if you have any further queries. We are more than happy to address all your questions. If you find this information helpful, consider sharing the article with as many people as possible.

Disclaimer:

Dear readers, please be advised that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided on this site is solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Additionally, share price predictions are intended for reference purposes only and are valid only under positive market conditions.

This study does not consider any uncertainties regarding the company’s future or the current market conditions. While this information is for informational purposes, we disclaim any responsibility for potential financial losses incurred based on the information provided on this site. We aim to offer timely updates about the stock market and financial products to assist you in making informed investment decisions. It is crucial to conduct your research before making any investment decisions.