From here you can know whether KPI Green Energy’s stock should be bought or sold. KPI Green Energy shares future predictions for 2023, 2024, 2025, 2030, 2035, and 2050.

nse: KPI Green Energy Share Price Target’s share has increased by +993.25

KPI Green Energy Share Price Target 2024, 2025, 2026, 2027, 2028, 2030, 2035, 2040, 2050

KPI Green Energy Share Price Target 2024

Based on analysis by stock experts, The share price range is set at ₹870.40 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹1440

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2024 | ₹870.40 | ₹1440 |

KPI Green Energy Share Price Target 2025

Based on analysis by stock experts, The share price range is set at ₹1487 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹1600.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2025 | ₹1487 | ₹1600 |

KPI Green Energy Share Price Target 2026

Based on analysis by stock experts, The share price range is set at ₹2000 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹2100.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2026 | ₹2000 | ₹2100 |

KPI Green Energy Share Price Target 2027

Based on analysis by stock experts, The share price range is set at ₹2500 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹2700.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2027 | ₹2500 | ₹2700 |

Read More

Rattanindia Power Share Price Target 2023, 2024, 2025, 2030 Complete information

BHEL Share Price Target 2023, 2024, 2025, 2026, 2027, 2030, 2035, 2040, 2050

KPI Green Energy Share Price Target 2030

Based on analysis by stock experts, The share price range is set at ₹3000 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹3200.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2030 | ₹3000 | ₹3200 |

KPI Green Energy Share Price Target 2035

Based on analysis by stock experts, The share price range is set ₹4000 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹4500

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2035 | ₹4000 | ₹4500 |

KPI Green Energy Share Price Target 2040

Based on analysis by stock experts, The minimum target price for KPI Green Energy is set at ₹5500, while the mid-year maximum target price is projected to be ₹6000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2040 | ₹5500 | ₹6000 |

KPI Green Energy Share Price Target 2045

Based on analysis by stock experts, The share price range is set at ₹11500 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹13500.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2045 | ₹11500 | ₹13500 |

KPI Green Energy Share Price Target 2050

Based on analysis by stock experts, The share price range is set at ₹20000 as the minimum, while after the year, the maximum target price for KPI Green Energy shares is expected to be ₹21000.

| Year | 1st Target Rs. | 2nd Target Rs. |

| 2050 | ₹20000 | ₹21000 |

| Years | 1st Targets (₹) | 2nd Targets (₹) |

| 2024 | ₹870.40 | ₹1440 |

| 2025 | ₹1487 | ₹2100 |

| 2026 | ₹2500 | ₹2700 |

| 2027 | ₹3000 | ₹3200 |

| 2030 | ₹1000 | ₹1300 |

| 2035 | ₹2000 | ₹2500 |

| 2040 | ₹4000 | ₹5000 |

| 2045 | ₹6000 | ₹8000 |

| 2050 | ₹10000 | ₹12000 |

About KPI Green Energy

KPI Green Energy Limited: Formerly KPI Global Infrastructure Limited

KPI Green Energy Limited, previously identified as KPI Global Infrastructure Limited, serves as the solar and hybrid arm of the KP Group. Established in February 2008, this distinguished company is based in Gujarat and specializes in the generation of solar and hybrid power. The core objective is to offer sustainable power solutions across diverse business verticals.

The company is actively engaged in the development, construction, ownership, operation, and maintenance of solar and hybrid power plants. Operating as an Independent Power Producer (IPP), it also provides services to Captive Power Producers (CPP) under the brand name ‘Solarism’.

KPI Green Energy Limited – Fundamental Analysis

| Metric | Value |

|---|---|

| Market Cap | ₹ 5,763.02 Cr. |

| Enterprise Value | ₹ 6,167.97 Cr. |

| No. of Shares | 4.02 Cr. |

| P/E Ratio | 78.62 |

| P/B Ratio | 8.35 |

| Face Value | ₹ 10 |

| Dividend Yield | 0.19% |

| Book Value (TTM) | ₹ 171.81 |

| Cash | ₹ 43.15 Cr. |

| Debt | ₹ 448.11 Cr. |

| Promoter Holding | 54.83% |

| EPS (TTM) | ₹ 18.24 |

| Sales Growth | 122.59% |

| ROE (Return on Equity) | 40.87% |

| ROCE (Return on Capital Employed) | 25.53% |

| Profit Growth | 75.70% |

To enhance our comprehension of the market performance, let’s examine the historical outlook of this share in previous years. Nevertheless, investors should exercise caution by considering the associated risks and prevailing market conditions before making any investment decisions.

Last 5 Years’ Sales:

| PARTICULARS | March 2019 | March 2020 | March 2021 | March 2022 | March 2023 |

|---|---|---|---|---|---|

| Net Sales | 34.51 | 59.28 | 103.50 | 219.02 | 487.53 |

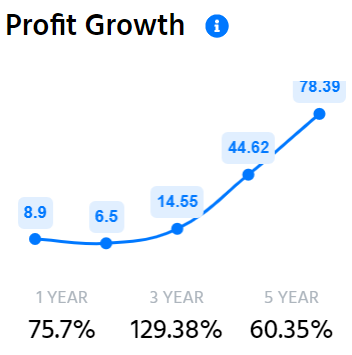

Last 5 Years’ Net Profit:

| Year | 2019 | 2020 | 2021 | 2022 | 2023 |

|---|---|---|---|---|---|

| Net Profit | 8.90 | 6.50 | 14.55 | 44.62 | 78.39 |

KPI Green Energy’s Last 5 Years’ Profit Growth Ratios

Profit Growth:

- 1-Year: 75.7%

- 3-Year: 129.38%

- 5-Year: 60.35%

KPI Green Energy Last 5 years’ Return on Equity (ROE)

- 1-Year: 40.87%

- 3-Year: 29.33%

- 5-Year: 21.32%

KPI Green Energy Limited Share peer’s company

- Kirloskar Brothers

- Shriram Pistons & Rings

- HMT

- Genus Power Infra

- Azad Engineering

Future of KPI Green Energy Share Price

Risk of KPI Green Energy Share

The company has a significant EV/EBITDA ratio, standing at 37.51, indicating a relatively high valuation in the market. Additionally, there is a substantial level of promoter pledging, reaching 49.01%.

KPI Green Energy Share Price Summary

KPI Green Energy 52 Week Low and 52 Week High, KPI Green Energy’s all-time high of 1487.70 rs.

| Metric | Value |

|---|---|

| Open | ₹1,485.40 |

| High | ₹1,487.70 |

| Low | ₹1,426.45 |

| Market Cap | ₹5.76T |

| P/E Ratio | 38.58 |

| Dividend Yield | 0.049% |

| 52-Week High | ₹1,487.70 |

| 52-Week Low | ₹390.00 |

Shareholding Pattern Of KPI Green Energy share

| Summary | 2024 |

|---|---|

| Promoter | 54.83% |

| FII | 1.86% |

| DII | 2.38% |

| Public | 40.92% |

Should You Invest In KPI Green Energy Ltd Shares?

The company has demonstrated robust profit growth, achieving an impressive 129.38% increase over the past 3 years. Additionally, the company has exhibited strong revenue growth, with a notable expansion of 101.85% during the same period.

The company has consistently upheld a healthy Return on Equity (ROE) of 29.33% over the past 3 years, indicating effective utilization of shareholder equity. Furthermore, the Return on Capital Employed (ROCE) has been maintained at a commendable level of 22.93% over the same period, highlighting efficient capital utilization.

Maintaining an effective average operating margin of 46.36% over the last 5 years, the company has showcased operational efficiency. Additionally, the company boasts an efficient Cash Conversion Cycle of 4.51 days, reflecting streamlined cash flow management.

In terms of financial prudence, the Cash Flow from Operations (CFO) to Profit After Tax (PAT) ratio stands at a commendable 1.70, underscoring the company’s adeptness in managing cash flow effectively.

Conclusion

This article serves as a comprehensive guide to the KPI Green Energy Share Price target.

The information and forecasts are derived from our analysis, research, company fundamentals, historical data, experiences, and various technical analyses. The article delves into the share’s prospects and growth potential in detail.

Feel free to comment below if you have any further queries. We are more than happy to address all your questions. If you find this information helpful, consider sharing the article with as many people as possible.

Disclaimer:

Dear readers, please be advised that we are not authorized by SEBI (Securities and Exchange Board of India). The information provided on this site is solely for informational and educational purposes and should not be construed as financial advice or stock recommendations. Additionally, share price predictions are intended for reference purposes only and are valid only under positive market conditions.

This study does not consider any uncertainties regarding the company’s future or the current market conditions. While this information is for informational purposes, we disclaim any responsibility for potential financial losses incurred based on the information provided on this site. We aim to offer timely updates about the stock market and financial products to assist you in making informed investment decisions. It is crucial to conduct your research before making any investment decisions.